Human vs. machine: 6 factors that will drive technology investment

It’s a perfect storm for technology companies. Tesla’s valuation is now four times that of General Motors, Ford and Chrysler combined. Apple was the first company to achieve a $2 trillion market cap. Amazon is trading at around $3,500 per share.

Our economy has experienced three years of digital transformation in the last five months. As reported by the Harvard Business Review, a recent study revealed that 63% of Fortune 500 CEOs believe they will increase technology spending even though they are under financial pressure.

Business owners need to take stock of underlying dynamics that are amplifying the technological shift:

1. Cheap money

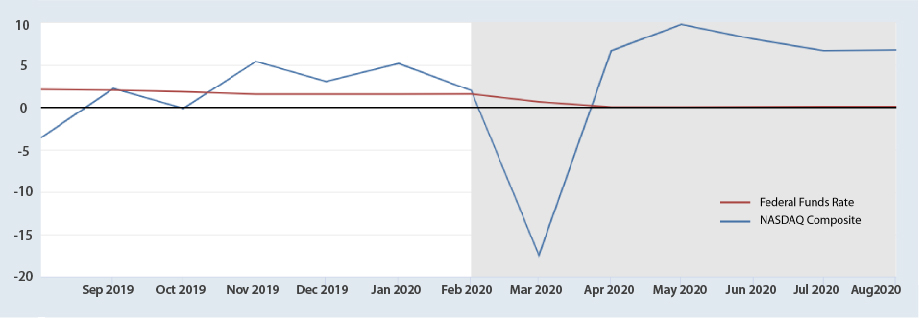

The Federal Funds Rate has hovered around 0.25%, and the Fed has indicated they will keep it that way for the next several years.

While public companies have the advantage of least expensive capital, private companies have never had access to such cheap money. On the heels of the PPP and EIDL stimulus packages, banks are flush with liquidity. As the economy stabilizes, they will be more willing to take risks.

Companies will not only refinance, but also take on new debt for acquisitions, real estate and technology. Pre-COVID-19, one of the hottest M&A trends was non-technology companies buying technology companies and vice versa.

2. The imbalance between cost labor and capital

Before COVID-19, the cost of labor was rising steadily (wages increased 3% in 2019). Saddled by strong demand, companies were paying higher wages and healthcare costs. Employees were demanding new benefits.

Government stimulus is keeping the cost of capital low when the cost of labor is high. There is incentive to automate.

Federal Funds Rate and NASDAQ

Source: Federal Reserve Bank of Saint Louis

3. Integration of collaboration suites

It’s as if collaboration tools like Slack and Zoom were shot out of a cannon. The war for bundling apps is on. Today Microsoft bundles Office, Teams, Skype and Power BI in one suite. Before long, their competition will have to do the same.

Soon all our systems will sit on a common platform and we will no longer adopt standalone tools like Monday and Asana. Within our firm, we manage client acquisition information in a CRM which is easily migrated to our project management system after the client is converted. The days of cobbled-together, disparate systems are over.

With this integration will come an reduction in the number of knowledge workers required to complete repetitive tasks.

4. Artificial intelligence and machine learning

Like something out of a Tom Cruise movie, machine learning is taking shape at a remarkable rate. Today’s technologies not only react to your activities—they anticipate what you will do in the future.

The runaway stock market will only fuel further investment by public companies in these expensive technologies. Cheap capital will amp up investment in bots and similar technologies that replace labor.

An important insight for SMBs (small- and medium-sized businesses) is that the advantages of larger companies are only growing in a period of rapid technology adoption. Flush with cash, large technology companies are buying up favored technologies, and smaller competitors will have to align with partners or acquirers that bring them into the fold.

5. Robotics

One of Wall Street’s emerging sectors is healthcare robotics. Given the realities of the pandemic, robots are now taking on highly technical surgeries. Machine learning will eventually decide which surgeries to schedule.

Conducting technical and high-value tasks may be the first domino to fall, but eventually the economics will dictate automation for more mundane tasks. Touchless payment systems in retail stores are quickly replacing cashiers. QR codes will further digitize restaurants and reduce the need for servers.

We expect the cost of labor as a percentage of revenue to decline in many industries in the next few years.

6. Adoption

Ironically, humans will be replaced by machines because of our willingness to accept them. We simply don’t have a choice. Any professional person today who is not tech savvy is being left behind.

Organizations will continue hiring younger people more capable of adapting in this world of rapid technology adoption. Someone has to run the machines.

Also by this author

- Trends report: 6 strategy considerations for a new world

- Trends impacting business in 2020 and beyond

- 10 steps to building a killer business strategy you can execute flawlessly

Category: Technology

Tags: coronavirus, Economy, Technology