Small business confidence stuck on pause [WSJ/Vistage Feb 2022]

While the past month has brought some calming of the headwinds of supply chain problems and Omicron-related absences, there has been little improvement in operational challenges of talent scarcity and inflationary pressures facing small businesses.

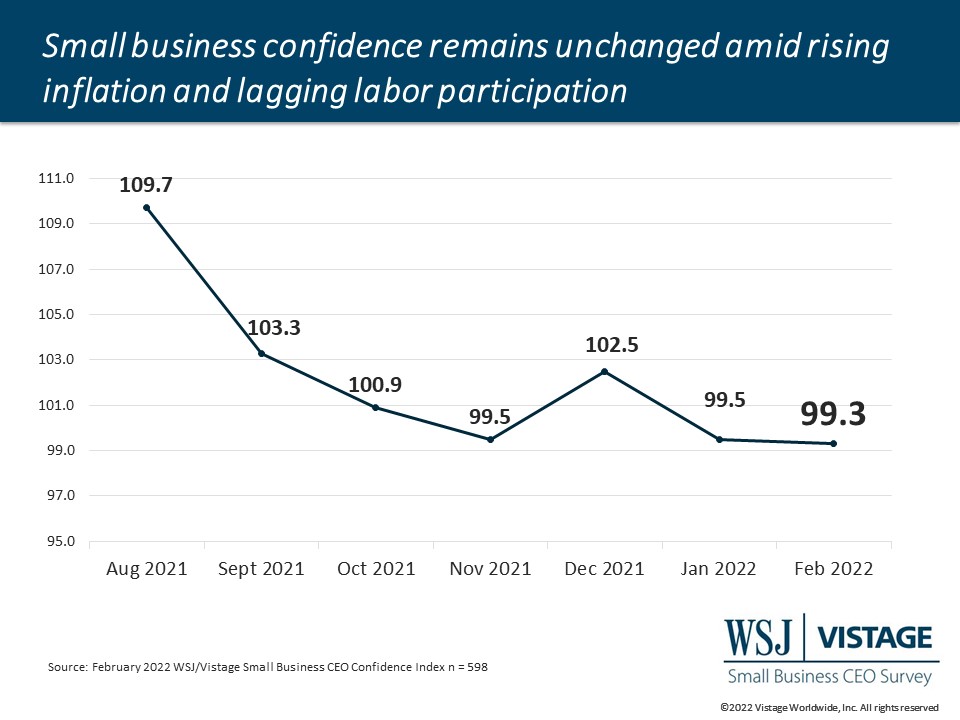

As a result, the WSJ/Vistage Small Business CEO Confidence Index declined marginally to 99.3 in February, nearly identical to the January 2022 and November 2021 readings of 99.5. An important point is that the sentiment reflected in the February survey was captured February 7-14, well before the Russia-Ukraine war began. The Omicron surge was waning, and any uncertainty created by direct or indirect impacts of the war had yet to surface. We will monitor these impacts in our next survey.

Small businesses struggle to get the talent needed to grow

The future looks bright for small businesses with 71% projecting increased revenues in the year ahead, a figure that has held steady over the last 3 months. The question is whether these small businesses will be able to meet customer demands given the continuing talent shortages.

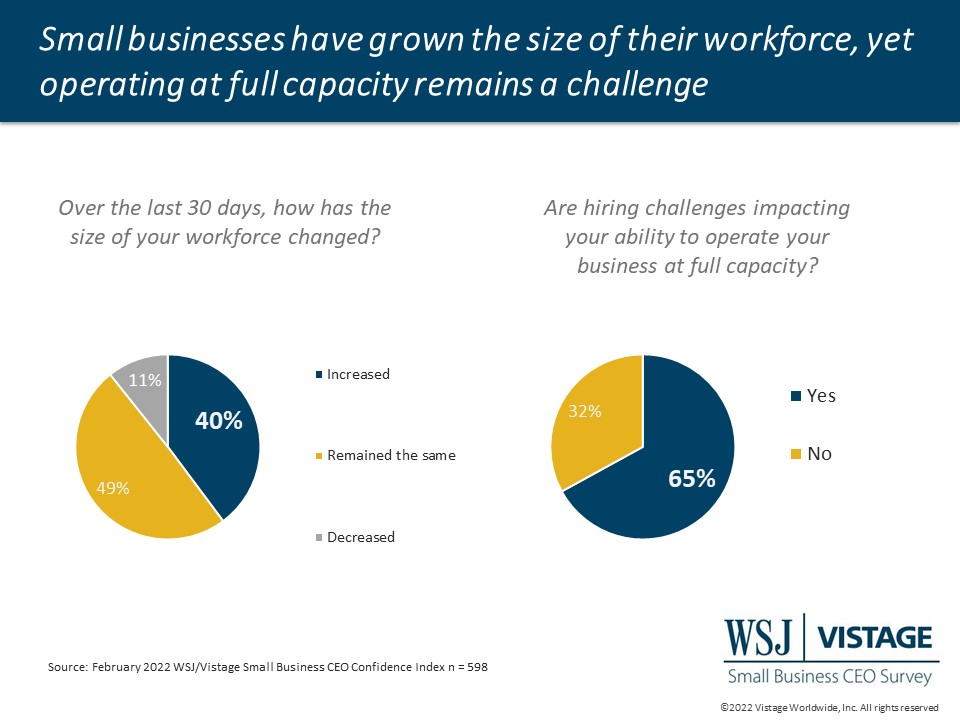

Nearly two-thirds (65%) of small businesses reported they were unable to operate at full capacity. This is despite the fact that 40% had increased the size of their workforce in the last 30 days. Unfortunately the hiring that small businesses have done in the past month may not have sufficiently filled their needs, as nearly 7-in-10 (69%) report plans to increase the size of their workforce in the year ahead.

Inflationary pressures continue, driven by wages and vendors

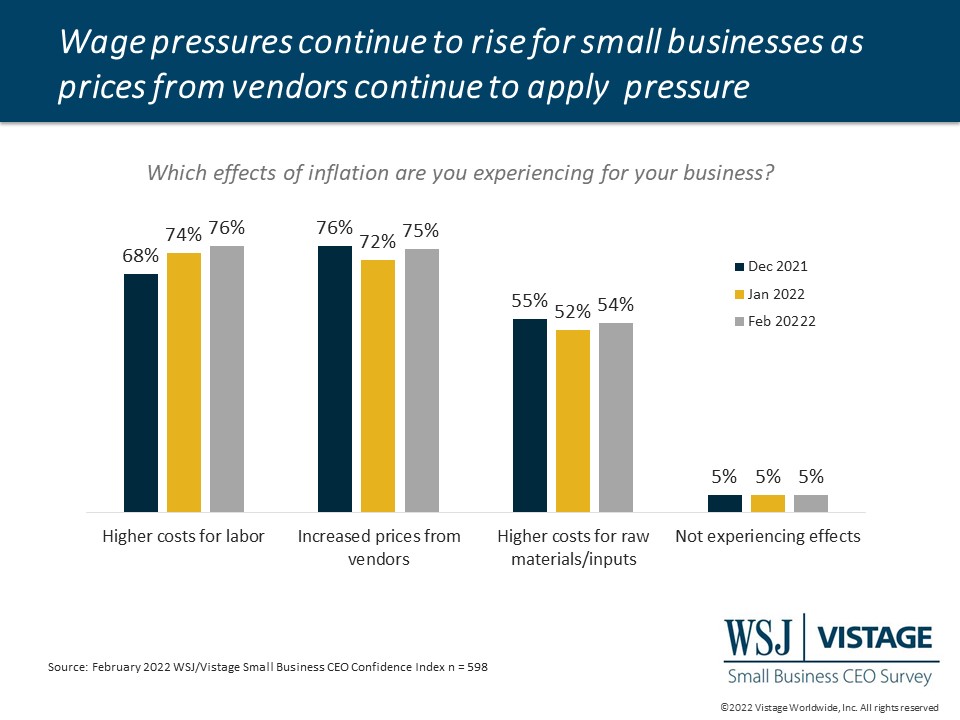

While there is a prediction that some of the pressures may ease, inflation is here to stay. Over the last three months, wage pressures have increased and are being cited as the biggest effect of inflation on small businesses. When you consider the proportion of businesses that are increasing headcount, combined with those offering increased wages, this is clearly the biggest concern – and cost – that small businesses are managing. Behind wages in terms of supply chain challenges, three-quarters of small businesses are experiencing increased costs from vendors, vendors who are most likely also dealing with the effects of wage increases and are raising their prices accordingly.

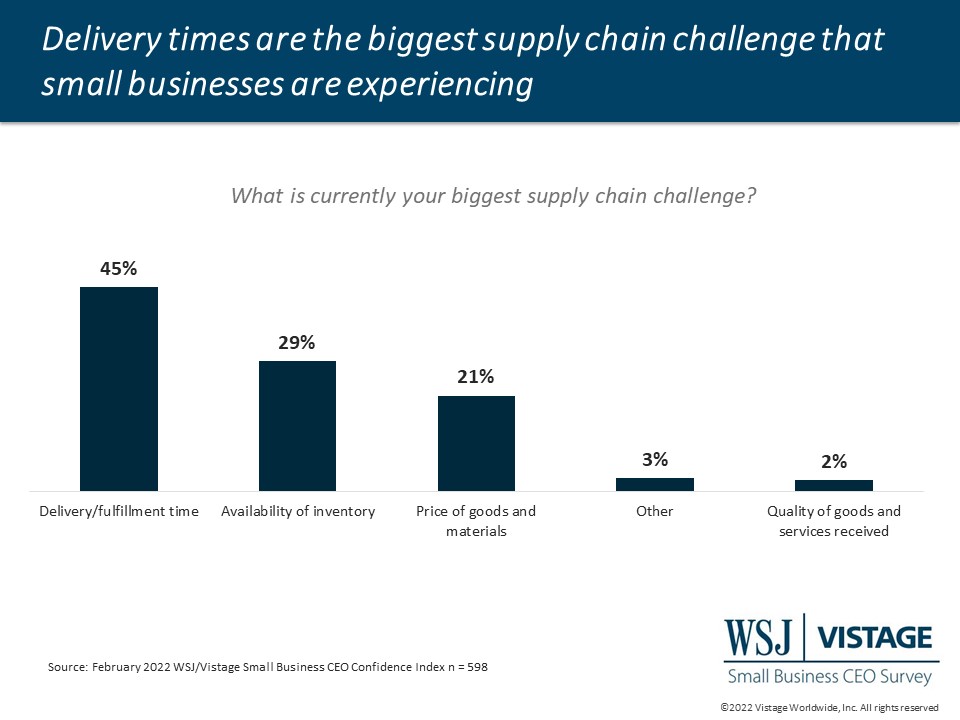

On the bright side, supply chain challenges appear to be easing, especially in regards to price. While 54% of small businesses are impacted by higher costs for raw materials and other inputs, just 21% of small businesses report that prices are their biggest supply chain challenge. Bigger challenges include longer delivery or fulfillment times and the availability of inventory.

Uncertainty overseas continues to grow

With delivery and fulfillment time topping the list of supply chain challenges, the impacts of the Russia-Ukraine war on the supply chain have yet to be determined for small businesses as the survey was in the field prior to the conflict’s escalation. New headwinds may spring up in the form of rising energy prices, sanctions against Russian banks, new supply chain challenges, or even managing vendors, employees and customers directly impacted by areas of conflict. Threats of Russian cyberattacks also are something small businesses will need to be vigilant about as they ensure the proper measures are in place to defend and protect their companies.

Download the February report for complete data and analysis

For the complete dataset and analysis of the February WSJ/Vistage Small Business CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic to learn more, including:

- Optimism about the future of the U.S. economy continues to decline.

- Expansion plans over the next 12 months hold, with 71% growing their workforce.

- Revenue expectations grow while profit expectations continue to moderate.

DOWNLOAD THE FEBRUARY 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD THE FEBRUARY 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The February WSJ/Vistage Small Business CEO survey was conducted February 7-14, 2022 and gathered 598 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our March survey, in the field March 7-14, 2022, will capture the sentiment of small businesses as the Russia-Ukraine War escalates.

Related resources

Category: Economic / Future Trends

Tags: coronavirus, Hiring, revenue, WSJ Vistage Small Business CEO Survey