Persistent uncertainty tempers small business confidence [WSJ/Vistage April 2022]

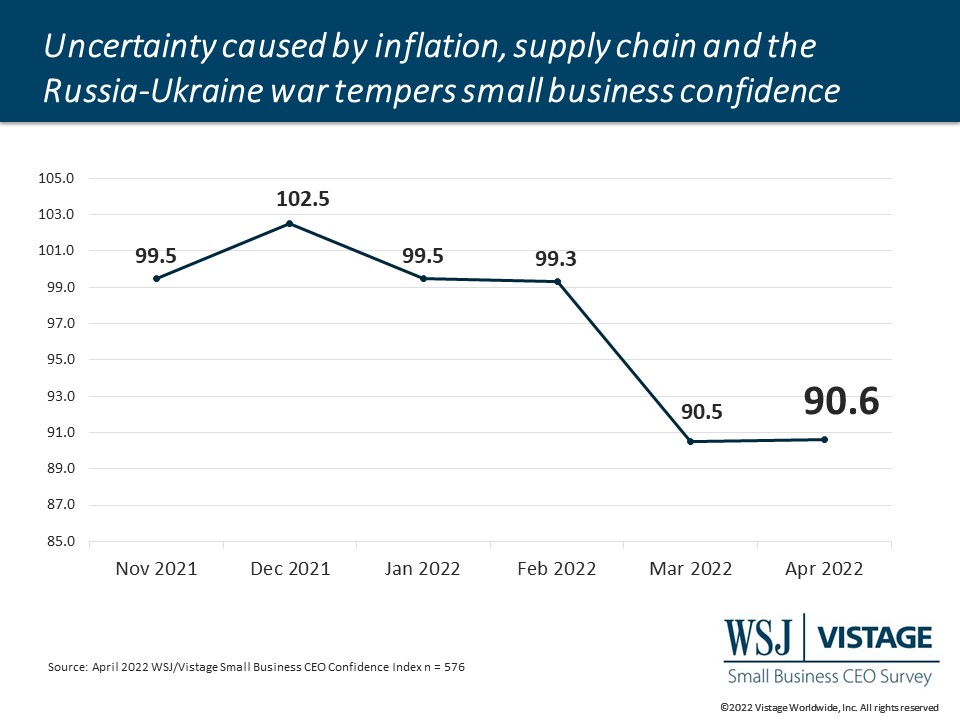

Last month, the uncertainty of the Russia-Ukraine war and its impact on the economy led to a dropoff in confidence among small businesses. While the war’s impact may have lessened, uncertainty persists for small businesses, largely in the form of inflation. U.S. inflation rose a record 8.5% in April, its sharpest increase since 1981. Couple that with the Federal Reserve approving a hike in interest rates by ¼ of a percentage point, and businesses are now unsure about investing in their future.

The April WSJ/Vistage Small Business CEO Confidence Index of 90.6 maintained last month’s level, however, it is the largest year-to-year decline — 22.1% — since the first few months of the pandemic.

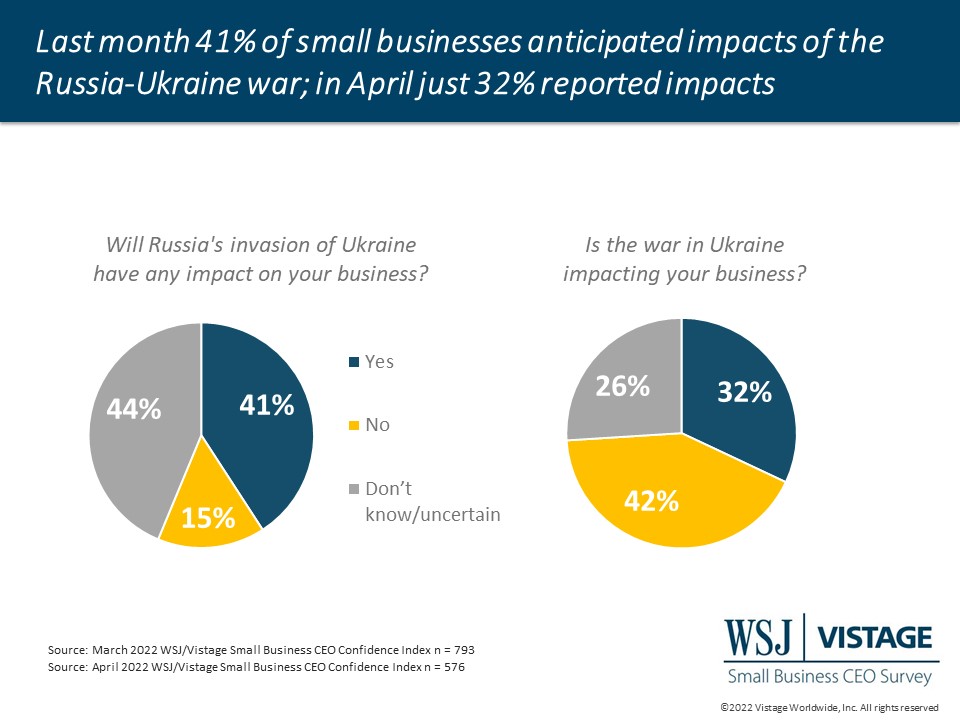

Impacts of the Russia-Ukraine war ease from last month

Last month, 41% of small businesses reported impacts from the war. This month, our survey found that the number had dropped to 32%. The impacts of the war vary for small businesses, from workers and suppliers in that region, to supply chain and rising energy costs being attributed to the war. Over time we will see and small businesses will come up with solutions to mitigate impacts.

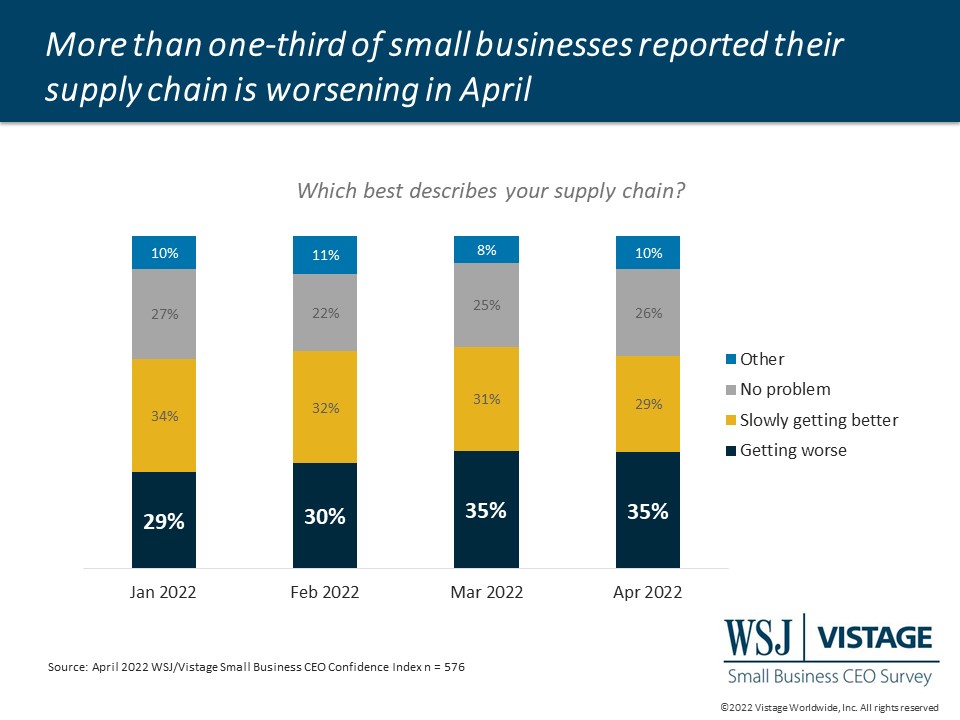

Supply chain remains a challenge

The good news is that there was no movement in small businesses in terms of worsening supply chain; 35% said it was getting worse, however, fewer reported that it was getting better and 26% said it was no problem. The current COVID-19 outbreak in Hong Kong is creating more supply chain pressure than at the height of the pandemic, and port closures will continue to impact those small businesses with suppliers in that area. This may make small businesses reconsider their supply chain dependencies.

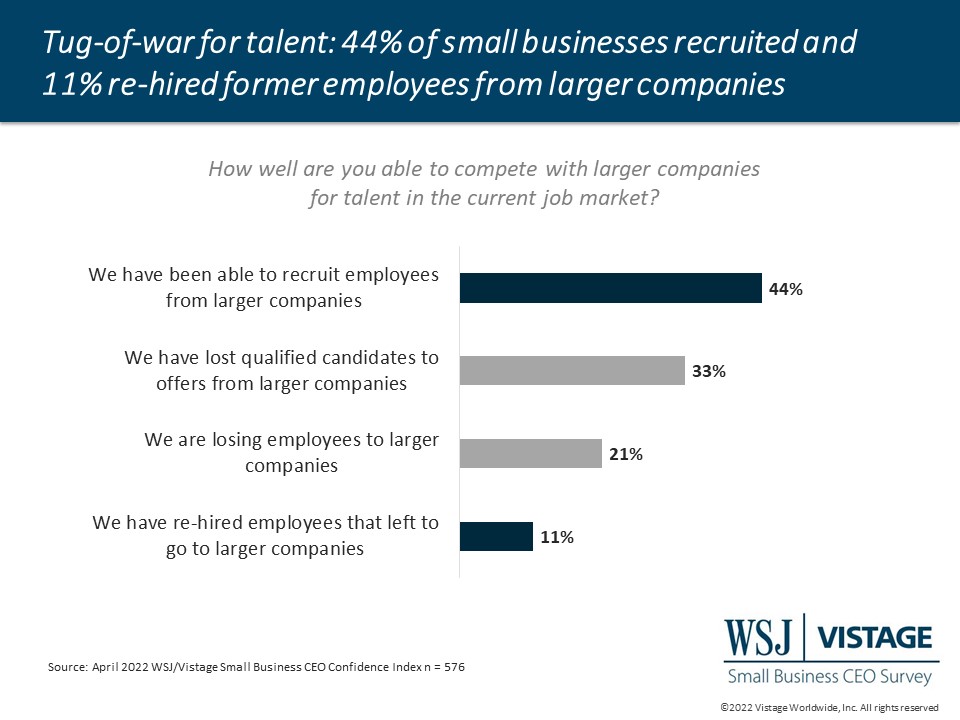

Competing for talent

In today’s labor market — one with just 3.6% unemployment — the competition is fierce for talent. While 54% of small businesses have lost employees (21%) or candidates (33%) to larger companies, 44% reported they have been able to recruit people from larger companies. And supporting the boomerang employee[a] trend, 11% of small businesses have rehired those they lost to larger companies.

Download the April report for complete data and analysis

For the complete dataset and analysis of the April WSJ/Vistage Small Business CEO Confidence Index survey from the University of Michigan’s Dr. Richard Curtin, download the report and infographic to learn more, including:

- Optimism about the future of the U.S. economy continues declining.

- Expansion plans over the next 12 months also decline, with just 61% planning to grow their workforce compared to last December’s 75%.

- Revenue expectations hold to last month’s reading while profit expectations declined slightly.

DOWNLOAD THE APRIL 2022 WSJ/VISTAGE SMALL BUSINESS REPORT

DOWNLOAD THE APRIL 2022 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

About the WSJ/Vistage Small Business CEO Survey

Interactive data from WSJ/Vistage Small Business survey

The April WSJ/Vistage Small Business CEO survey was conducted April 4-11, 2022 and gathered 576 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our May survey, in the field May 2-9, 2022, captured the sentiment of small businesses as the Russia-Ukraine War escalates.

Related resources

Category: Economic / Future Trends

Tags: Hiring, revenue, Russia-Ukraine, WSJ Vistage Small Business CEO Survey