Hiring and retention remain top priorities for small and midsize businesses

The intensity of the Talent Wars may have eased, but hiring remains both a key focus and priority for CEOs of small and midsize businesses (SMBs). The economic cycle’s uncertainty and volatility have made CEOs hypervigilant about their markets and growth implications. Despite today’s pressures of inflation, interest rates, cost of gas, supply chain, and increased costs, hiring and retention remain critical to CEOs of SMBs.

According to the Q2 2022 Vistage CEO Confidence Index survey, conducted June 6-13, 2022, 65% of CEOs reported that hiring challenges are impacting their ability to operate at full capacity. That’s down from the 72% recorded in both Q1 2022 and Q4 2021, yet still a significant economic headwind.

The Big Upgrade

May 2022 data shows that 4.3 million workers quit their jobs, part of what many have called the “Great Resignation.” This number continues to be abnormally high, in fact, more than twice as high as what was reported 10 years ago in May 2012 and almost 1 million more quits than May 2019. The data — released from the U.S. Bureau of Labor Statistics at the end of May — show that there are 11.3 million job openings, which translates to roughly 1.9 jobs per applicant. This confirms that the labor market is still an opportunity-rich landscape for workers. So while growth is slowing and geopolitical issues drive uncertainty, the competition to retain and hire workers remains strong regardless of how the economy swings.

In fact, the “Great Resignation” has, become the “Big Upgrade” as workers of all types and at every level look for a better work experience in terms of role, responsibility, compensation, benefits, work environment and flexibility. The requests for strong culture, rich growth opportunities and a flexible workplace made by the Millennial/Gen Z workforce before the pandemic have become demands in today’s competition for talent. With unemployment still historically low, the empowered workforce will continue to have options.

Biggest Business Challenge

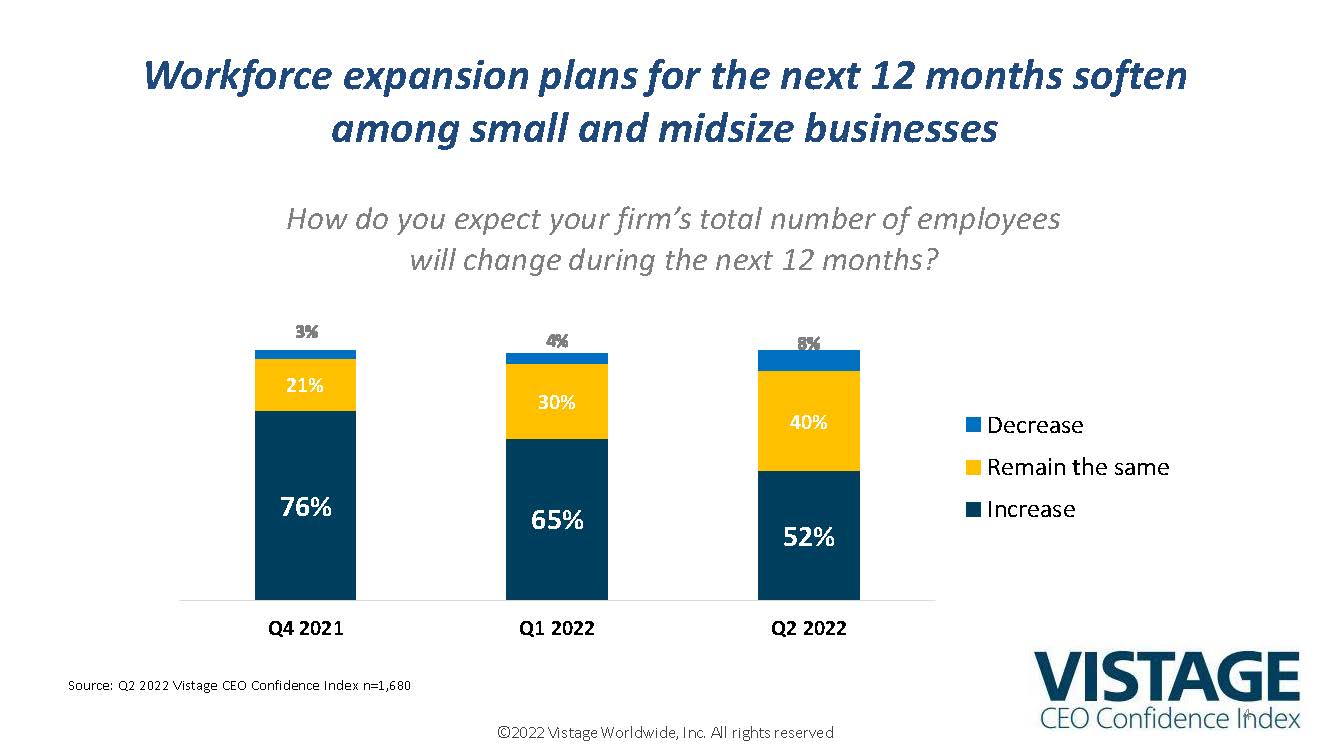

Hiring and retention were the most common responses from CEOs who were asked about their most significant business challenges in the Q2 survey, despite problems with inflation and a slowly-healing supply chain. CEOs are continuing to hire, working hard on retention and are less than eager to let hard-won workers go. While down compared to Q4 2022, comparing expansion plans to those of the pre-pandemic economy, 52% of CEOs plan to increase their headcount in the year ahead, which is down just 4 points from 56% recorded in Q2 2019.

While this has declined from 76% recorded in Q4 2021, it is important to note that since the beginning of 2022, 51% of CEOs have already increased headcount, indicating that many of the projected hires for the year have already happened.

Staffing to meet current demand (76%), scaling for increased customer demand (52%) and expanding to new markets (24%) were the key drivers for those who reported a recent increase in staff.

Of the 11% who have decreased staff this year, only 23% expressed concerns about the economy as a factor in that decline. The top impacts on workforce declines included: difficulty attracting and retaining employees (63%), difficulty competing with larger companies for talent (40%) and a decrease in demand (21%).

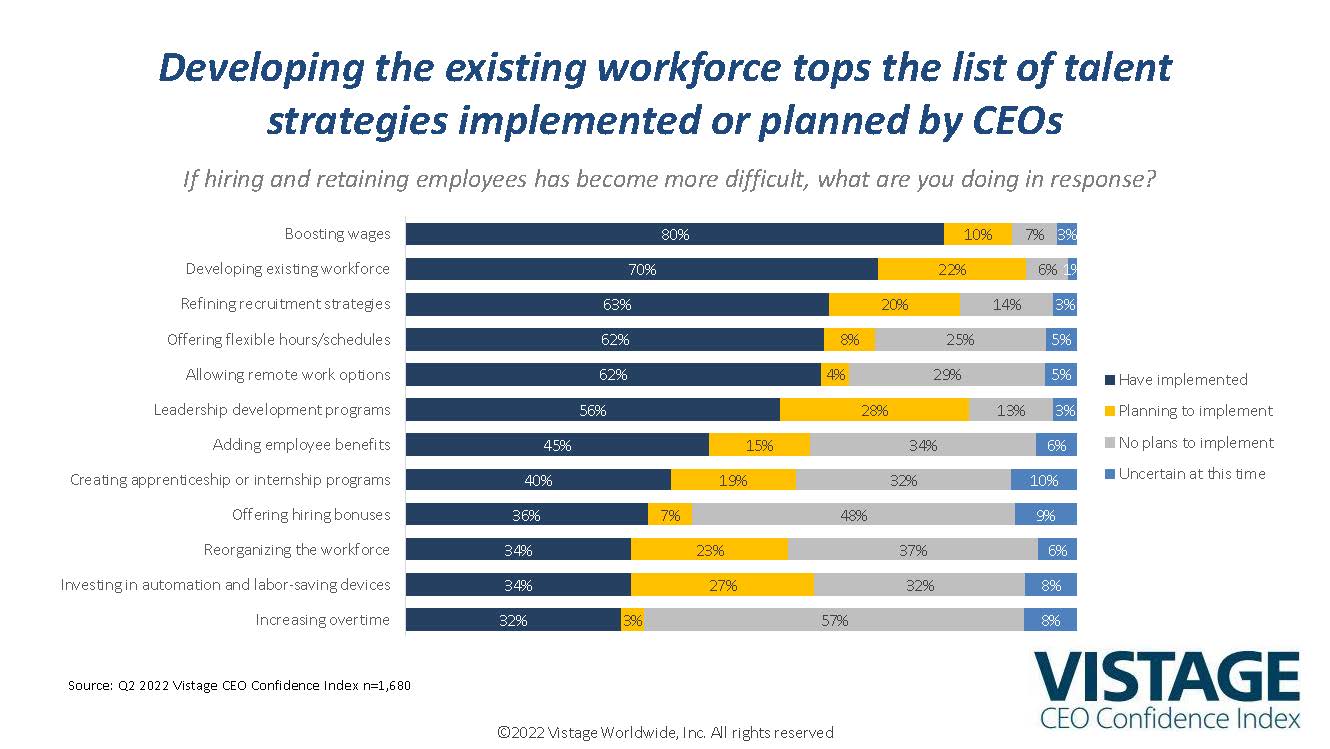

To address hiring challenges, 80% of small and midsize businesses have boosted wages, with an additional 10% planning to implement wage increases in the future. Second to boosting wages, 70% of CEOs are investing in employee development with another 22% planning to do so in the future. Development efforts are twofold, first as a differentiator to attract new employees, and secondarily to retain and improve the existing workforce. Remote work options continue to be an employee demand and 62% of CEOs are allowing remote work options.

How to Hire

What worked in the pre-pandemic days of the Talent Wars needs to evolve to meet the radially evolving and highly volatile labor market of today. 63% of CEOs have already refined their recruitment strategy with another 20% planning on enhancing their strategy. It starts with focus from the top and includes leveraging the entire organization. With a renewed focus, prospecting for talent is increasingly coming from new sources while companies strive to differentiate their workplace.

A recent Vistage Chair roundtable featuring three top Vistage Chair CEO coaches who represented more than 125 members captured some of the best practices being utilized to improve recruiting:

- Adding recruitment capabilities, including dedicated positions

- Using recruiting firms for managers and executives

- Reviewing the process and timing to improve the application and onboarding process

- Hiring out of co-op programs

- Outsourcing and offshoring: looking to other countries for lower-cost employment

- Making hiring an issue for the entire organization

- Offering incentives for referrals

- Including flexible options as a differentiator (ex: a 4-day work week)

- Upgrading environmental factors to make the workplace appealing, comfortable and safe

- Investing in apprenticeship programs

Retention First

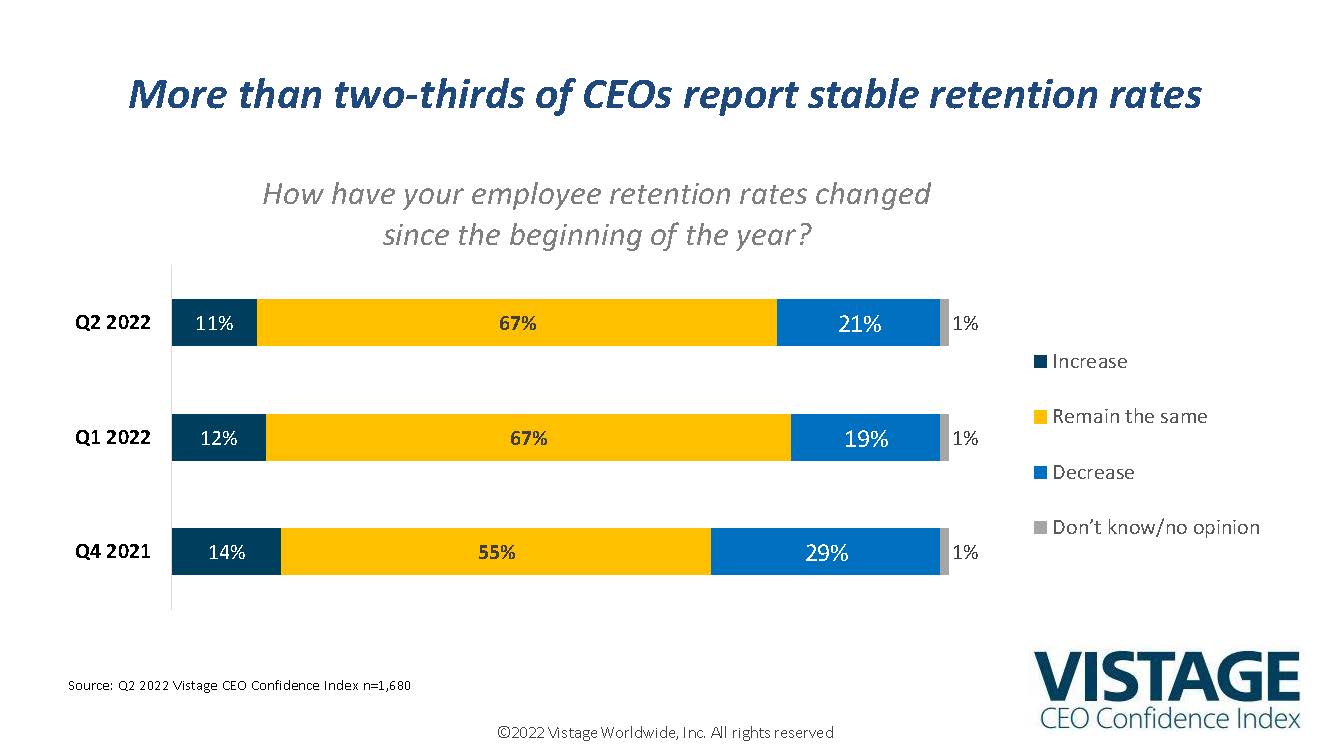

Retention rates have stabilized in the first part of the year, with 20% of CEOs indicating their retention rates have decreased since the beginning of the year, down from 29% in Q4 2021.

Retention initiatives are beginning to pay off, with increased investments in employee development leading to better performance while also becoming a competitive differentiator to retain and attract workers.

Another factor that impacts retention is the development of bosses, those leaders who directly manage workers. Long ignored, more CEOs are investing in leadership development, recognizing that no one’s job has changed more as a result of the pandemic than the boss. Leading, coaching and managing remote and hybrid workers is a brand new challenge for most bosses. Combined with the emergence and new requirements of the Millennial and Gen Z workforce — now the largest working demographic — bosses need help.

Our research report, Building Better Bosses, highlights these challenges and provides recommendations for leadership development.

Also captured in the Chair roundtable were best practices being utilized by CEOs to improve retention:

- Improving the onboarding process and what happens on day one

- Treating employees like customers, offering choice and flexibility

- Upgrading environmental factors in the workplace that make it more appealing, safer and more comfortable

- Reducing repetitive work by leveraging technology and outsourcing

- Conducting stay interviews, especially for at-risk employees

- Developing career paths to “co-create a future”

- Conducting workflow and capacity analysis to look at creative sourcing internally or externally

- Rewarding and recognizing performance

Hourly workers present a unique challenge. Well known for their willingness to walk across the street for an additional $1/hour, retaining hourly workers requires a competitive rate, development/advancement possibilities and a compelling workplace to attract and retain these workers.

To help CEOs think about how they can best address the hiring challenges surrounding frontline hourly workers, an expert panel of top Vistage speakers shared their insights. Learn tactics from experts on retention, hiring and culture to improve your ability to attract and retain this high-turnover portion of the workforce.

No End in Sight

The feverish pace of hiring will continue to slow some, but the significance of employee retention and the importance of a dynamic recruiting strategy will only grow. Until layoffs become the norm and unemployment rises, the Big Upgrade will continue. Choices may be fewer, but they’re still abundant.

As the old adage goes, “a recession is when your neighbor losses his job, a depression is when you lose yours.” Right now, few employees are losing their job outside of specific sectors like technology, crypto and those that exploded because of the pandemic (Peloton, Netflix and Amazon). In fact, those 4.3 million workers who quit in May are either aggressively looking for that upgrade or having that upgrade find them.

Related Resources

The CEO Pulse: Hiring Resource Center

Category: Hiring, Recruitment, Sourcing