Top 10 M&A Drivers for 2012- Are CEOs in a Tug of War room?

It’s not easy being a CEO looking for growth this year. Stemming from the need to increase top line sales there is certainly no lack of effort to find it. But as the pressure for growth continues to build, chief executives are coming face to face with the reality that if they can’t grow organically (internally) their companies could stagnate, or worse, fail to grow under their watch. So it’s no mystery that more and more CEOs are returning to mergers and acquisitions for a solution. What most find or already know as a fact is; M&A is no game; or is it?

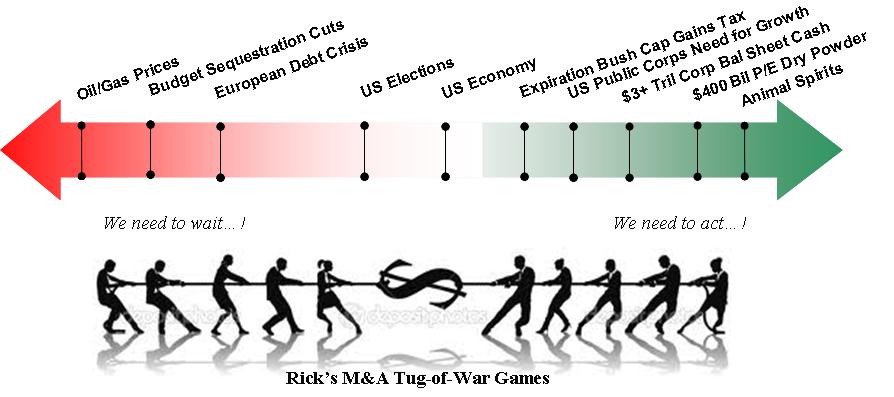

Notwithstanding the dynamics specific to each industry, 2012 in particular offers CEOs an interesting spectrum of macro economic opposing forces to consider. When I researched these forces I found and hence created a way to visualize what I was seeing in the market, and it is a game, a game of Tug-of-War with opposing advisors on each side of a macro M&A deal-driver spectrum.

To better understand each team’s position I spread several (not all) key measures, or forces, along a deal spectrum tug-of-war rope by the weighted affect I believe each has on a chief executive’s decision to close a deal this year. Red means “no” green means “go.” If you’re a CEO reading this you’re likely well aware of your advisors internally and externally pulling you to one side or the other.

On the left side are your Bears, those who believe in the forces pulling against doing a merger or acquisition. On the right side are your Bulls, and depending on deal size have already closed $1.3 trillion in M&A transactions in 2011 according to Thomson Reuters, a 24% increase over 2010. So which side should you be pulling for? Well. The answer may depend more on your appetite for risk and adventure. Just remember, from where I sit, Bulls attack, Bears scavenge. So let the games begin:

On your left is the Bear Team: Their advice is clear, you need to wait…Why?

1) Oil & gas prices are going up:

If energy prices remain high most notably oil & gas to fuel commercial transport and consumer autos, demand and confidence could take a hit, again. And those against doing an M&A deal will argue a target whose earnings are linked to energy prices could suffer, and that uncertainty makes putting a price on such a deal too risky. What if you buy a CPG company today, for instance, and its value drops the next as a consequence of higher energy costs to consumers? Makes sense to hold back and wait, doesn’t it? If oil & gas prices remain high, the damage could last years, says the Bear team.

2) Budget Sequestration Cuts:

Remember the Budget battles in Congress back in December 2011, when if no balanced budget decision could be agreed to by Congress the Federal Government would not be able to pay its bills? The result, you may recall was a forced Budget sequestration measure in the Budget Control Act whereby if no deal was reached $1.2 trillion in automatic growth spending cuts in certain government programs kicked in beginning in 2013. Opponents of Sequestration argue allowing such cuts will hurt our fragile economy and job growth. And without further action the affects of these cuts could in turn further damage corporate earnings, consumer sentiment/demand and hence US GDP. So why would aUScorporation sensitive to these risks like most of the S&P invest in M&A say your Bears? They argue such uncertainty is a legitimate reason to hold back this year, or at least for now.

3) European debt crisis:

For the last year or more US Equity markets have bounced up and down like a ragdoll on a raging bull. As corporate CFO’s try to get their arms around the actual risk (exposure) to a widespread EU banking crisis (a consequence of failed EU member states to pay their bills), the uncertainty of contagion seems to have been averted. Still, Wall Street doesn’t like uncertainty any more than corporate CEOs. But as of April 2012,Greece, the leading troublesome player in the game dodged a bullet, “calling” in old bonds and replacing them with newer ones. The ECB with its LTRO (long term refinance operations) underway may just provide enough stabilizing forces to hold things together longer term. Together these are favorable signs of mitigating future problems from other EU member states likePortugalandSpain, at least for now. But this all begs the question for any M&A targets in the EU by US multinationals, say the Bears. How can US CEOs calculate risk should they advance a deal with a potential partner over there? If the EU is already in recession according to a recent European Commission report, isn’t acting now too risky?

4) US elections in 2012:

As of April 2012 the USPresidential election this November is a toss-up with Republican-likely Mitt Romney against President Obama sure to be a campaign battle to remember if not only for ideology, but also the amount of money estimated to be spent getting the message out on both sides. According to research firm Borrell Associates spending for all federal and state elections will reach a record $9.8 billion in 2012, twice the amount in 2008. And there is a lot riding on winning or losing from a corporate M&A standpoint too. Most notably lowering corporate taxes [currently with a top rate of 38%] which is being proposed by both parties (yes I said lowered) to 25-28%. But their tug of war has one side wanting tax increases on the wealthy, while the other side wanting cuts in government spending. Therefore, I put this issue in the middle of my deal spectrum rope because we just won’t know the full impact either way until 2013, if then. So what if a CEO spots a good M&A target now? The Bears tug hard, and say no.

5) US economy in 2012:

Despite the vacillation of recent labor market figures, consumer confidence is up. But add that to an increase in automobile sales and improving Conference Board (Leading Economic) Indicators, and it’s still not enough to win us over, say Bears. Measured alone these nascent increases are not enough to pull the trigger on a new deal they say. Not with real Q2 GDP growth under 3%. Many other signs such as persistently high unemployment rates, lack of housing demand, commodity price increases, and concerns about government spending & regulation are still in play. In fact, CEO confidence while improving in January dipped again in March 2012 citing “tax uncertainty” in 2013, according to a monthly survey by Chief Exective.net. And absent more convincing signals, theUSeconomy remains susceptible to myriad downside risks say the Bears, “no deal.”

So do the Bears win? The M&A Bulls say no way. Just take a look at the over $1 trillion in US M&A activity in 2011. If most of the downside risks were perhaps even more evident and uncertain in 2011, why such a robust year? Even if 2012 starts slow, they argue M&A deals come in clumps during the year and can catch up quickly in deal volume and value in year over year comparisons. This supports the notion that smart CEOs know when to make a move. And I’m with them. I believe the M&A Bull team will win the tug-of-war in 2012, not necessarily because of what CEOs don’t know about the future, but rather because of what they do know. And it’s no bull, so pay attention:

On your right is the Bull Team (green means “go”): Why?

6) Expiration of Bush tax cuts:

Once set to expire in 2010, what has come to be known as the Bush era tax cuts signed into law under the 2001 & 2003 economic and jobs tax relief acts were extended. They were further enhanced to postpone an expected increase to the AMT. These actions among others by the Fed were needed in an all out effort for the government to stimulate economic growth in theUS. But given the lingeringUSeconomic malaise since 2008, Congress & the Obama Administration extended the expiration date from 2010 to December 2012. So what does that mean? Well, on the M&A deal spectrum it means the battle for how to pay for continuing these tax cuts is likely coming to end, and hence in 2013, taxes for many, are going up. For M&A Bulls this means Capital Gains taxes are set to increase from 15% to 25% in 2013 as a consequence of Bush and Obama tax policies combined. That translates to an automatic tax bill increase of $100,000 for every $1 million in capital gains if you don’t close the deal this year. And this impact according to Forbes Magazine, and The Washington Post, could compel asset owners to unload now, and NOT wait for 2013. The Bulls say this single force alone could drive a significant number of new deals to close in 2012, just to avoid the tax bite.

7) US corporations need for growth:

Despite abnormally low trading volume in US equities (off 11% according to the Tabb Group so far in 2012 compared to last year) ‘earnings’ for public corporations still remain the key growth and investment measure for investors. So the concern most CEOs hear from the Bull side is how to grow earnings and hence value to shareholders. If historically all companies invested in themselves first, and in turn, reaped a certain amount of ROI for the effort, how does a CEO feed the “growth” monster if not from internal investments? The answer is M&A say the Bulls. Essentially, unless corporate CEOs want to embrace stagnation and watch earnings (and stock price) drop and investors run away, they best venture outside more, and hunt for new acquisitions this year.

8) What to do with $3 trillion in cash:

At last count according to JP Morgan Chase by the end of March 2012, US corporations hoarded $3.6 trillion in cash on their balance sheets! This is up from $2 trillion in 2011 as the risk-averse Bear team continues to advise CEOs to pull more cash in-house. They fear liquidity risks, limited investment choices, and languished economic prospects across the board. Moreover, asUScorporations accumulated green-backs they also cleaned up their over-levered balance sheets. The result is a healthy hoard of shareholder cash that can’t just sit around earning next to nothing from low interest rates. But rather cash that must be used for dividends, stock repurchases, and M&A.

9) $400 billion in Private Equity dry powder:

According to PitchBook research, Private Equity firms which total over 5000 in theUShave also held back from deploying cash from their limited partner funds as the recession made finding good investment targets a lot harder to find. Given the alternative by charter to invest or return the money to investors, P/E groups are getting much more aggressive and eager to find new M&A targets. In fact, in 2011 P/E groups did invest nearly $150 billion according to PitchBook research in newUSacquisitions, and still have $400 billion in cash to deploy. This growing mountain of money can’t wait around much longer say the Bulls, it’s a huge catalyst for new deals. Let’s act now!

10) Animal Spirits:

And finally, let’s be honest say the Bulls. It’s a new and dynamic market we’re in. All these measurements above are fleeting, and will continue to change. You just have to change your mindset. Believe in your ability to know when to act, to gather smart facts that help you see through the economic noise to the smart road forward. Everyone we know still wants a better life for themselves and their family, it’s in our DNA. And as long as corporations are managed by humans, corporations will be an extension of our human behavior and expectations. It’s in our “animal spirit” to want to explore, open new frontiers and get on with it. Distill that down to any practical level and you get action. For us Bulls this means pulling even harder, and to act on the M&A deal that’s smart, strategic, and accretive in 2012. Are there risks? Of course, but standing still should not be one of them.

_______________________________________________

About the author: Rick Andrade is a Managing Director at Calabasas Capital, a Los Angeles based investment banking firm helping buy, sell & finance middle market companies. Rick has his BA and MBA from UCLA along with his Series 7, 63 & 79 FINRA securities licenses. He is also a Real Estate Broker, a volunteer SBA/SCORE instructor, and blogs at www.RickAndrade.com on issues important to middle market business owners. He can be reached at [email protected]. This article should not be considered in anyway an offer to buy or sell a security. This is for informational purposes only. Buying or selling a security involves substantial risk. Investments may be worth more or less than the original investment. Securities offered through Fallbrook Capital Securities Corp. Member FINRA/SIPC.

Category: Business Growth & Strategy

Tags: CEO, mergers and acquisitions, Strategy

[…] S$24000, with a degree and about 8 years of experience….. Hope this helpsPowered by Yahoo! AnswersSandra asks…Which division in Investment Banking offers the highest salary?To fresh graduates. and…/h2>To fresh graduates. and 5 years down the lineadmin answers:As long as you are on the investment […]

[…] http://blog.vistage.com/business-strategy-and-management/top-10-ma-drivers-for-2012-are-ceos-in-a-tu… This entry was written by rickandrade121, posted on May 14, 2012 at 9:32 pm, filed under News & Views. Bookmark the permalink. Follow any comments here with the RSS feed for this post. Comments are closed, but you can leave a trackback: Trackback URL. « The Future of M&A in 2012 […]

Excellent article, and totally unbiased. One other factor I might have included that the business community continually brings up as a reason to take a wait and see position is the fear of new regulations coming out of Washington.

[…] http://blog.vistage.com/business-strategy-and-management/top-10-ma-drivers-for-2012-are-ceos-in-a-tu… […]

As an HR guy, I am surprised that companies so often pursue an acquisition of a firm rather than go after the talent that makes the firm of value to begin with. Given the lack of success and the cost associated with the traditional company purchase, I think this option needs to be given more consideration.