CEO confidence stabilizes in May WSJ/Vistage Survey

The economic optimism of small-business CEOs has stabilized at good levels, according to the latest Wall Street Journal/Vistage Small Business CEO Survey.

The May 2018 survey, which had 741 respondents, recorded a CEO Confidence Index of 112.4. By comparison, the index was 113.6 one month ago and 110.9 one year ago.

These are favorable measurements, noted Dr. Richard Curtin, a researcher from the University of Michigan who analyzed the survey results. “While the Confidence Index is below January’s six-year peak — which was sparked by the passage of tax reform legislation — confidence has remained at the top of the range it has traveled since the survey began in mid-2012,” said Curtin.

Other key findings from the survey include the following.

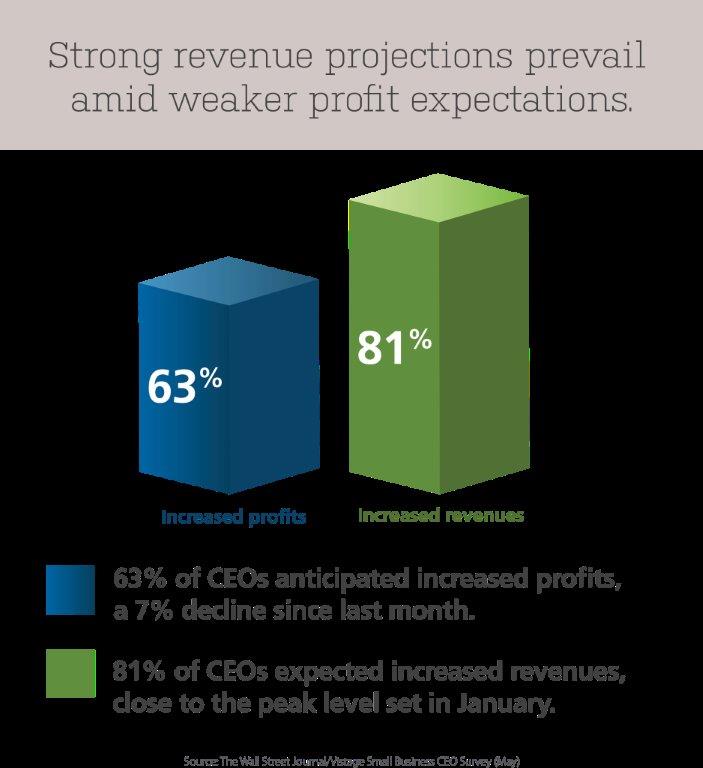

CEOs expect greater revenues, lower profits

Expectations about revenue and profit growth varied in the May survey.

The majority of small-business CEOs (81%) said they anticipated higher revenues in the next 12 months. This is nearly equal to the 82% recorded last month and the six-year peak of 83% recorded earlier this year.

However, the percentage of CEOs who expected profit gains dropped to the lowest level since late 2012. In May, only 63% of CEOs said they anticipated profit increases in the next 12 months, compared to 70% of CEOs in April.

“Higher costs of materials, higher interest rates and potentially higher tariffs are the most likely candidates for higher costs and thus lower profits,” said Curtin. “However, the decline in outlook on profitability would imply relatively large expected total cost increases. While it could just be an anomalous result that will correct itself next month, if the decline in expected profitability is confirmed or accelerates in subsequent surveys, it could play a significant role in how firms decide on additional investment expenditures.”

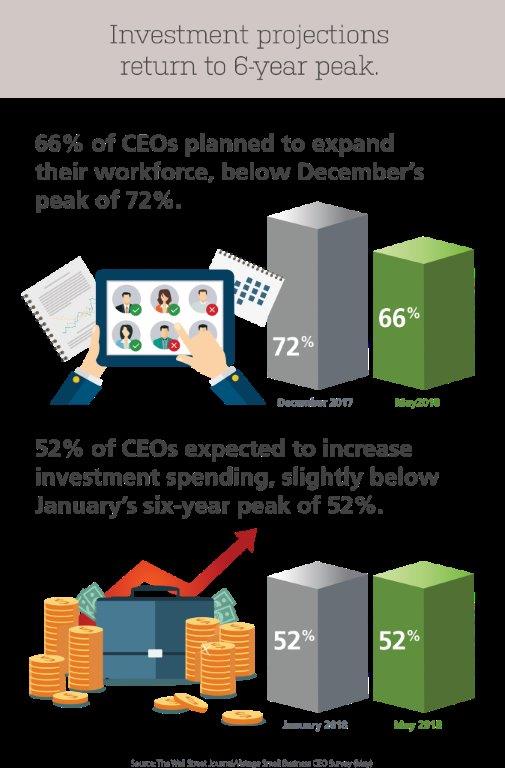

Business expansion plans remain steady

Business expansion plans remain steady

Small businesses plan on increasing their hiring and investment spending in the year ahead.

One-third (66%) of CEOs said they will increase their workforce in the next 12 months. This is similar to last month’s 65% but below the six-year peak of 72% recorded in December 2017.

About half (52%) of small-business CEOs said they plan to expand their investment expenditures, compared to 48% one month ago and 47% one year ago. This ties the six-year peak that was recorded in December 2017, January 2018 and February 2018.

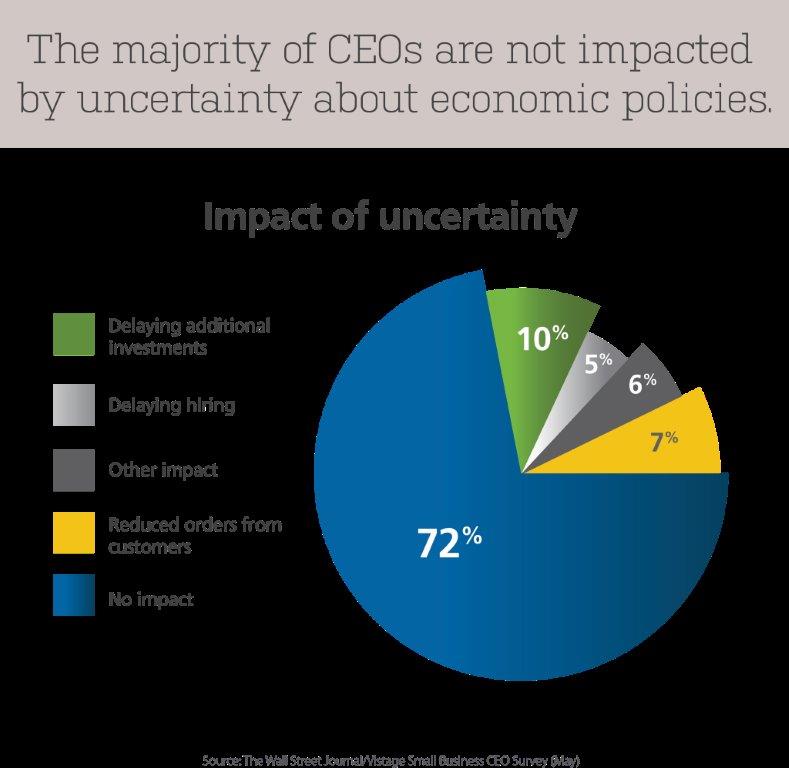

Most small firms unaffected by economic uncertainty

Most small firms unaffected by economic uncertainty

Small businesses remain largely unaffected by doubts about the U.S. economy and economic policies. Nearly three-quarters (72%) said that the uncertainty had no impact on their business.

However, 10% of small firms said they are delaying additional investments and 5% are delaying additional hiring as a result of economic uncertainty. Another 7% reported a reduction in orders from customers.

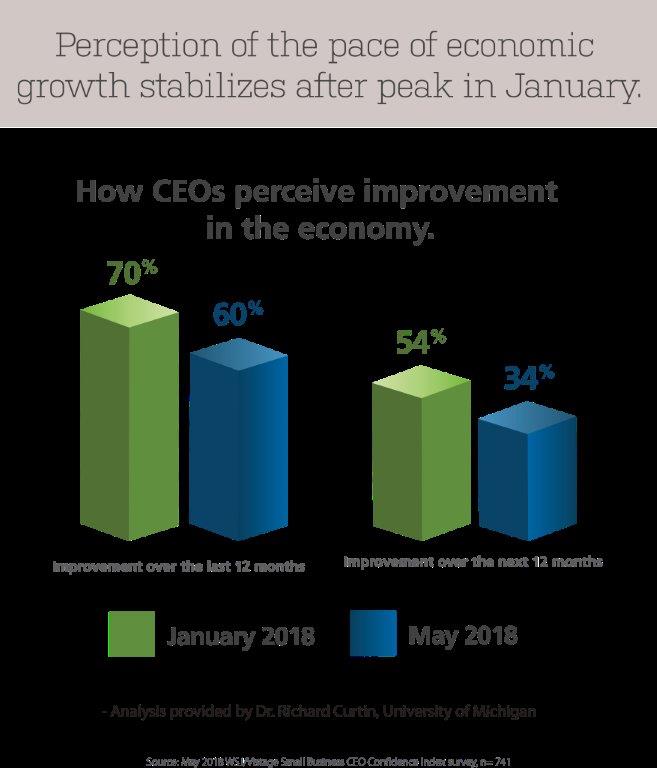

CEOs anticipate slower economic growth

CEOs anticipate slower economic growth

Small-business CEOs expect the economy to grow more slowly this year. In the survey, about 60% of CEOs cited recent economic gains, which is similar to the previous two months but below the 70% recorded in January.

Only 34% of CEOs said that they expected the economy to grow in the year ahead. Again, this is similar to the previous two months but significantly lower than the 54% recorded in January.

“While some of the decline could be due to the expectation of interest rate hikes, it stands in sharp contrast to economists’ forecasts for a stronger economy in 2018 than in 2017,” said Curtin.

Category: Economic / Future Trends

Tags: Economy, Hiring, WSJ Vistage Small Business CEO Survey