After rising for 6 consecutive months, small business confidence dips [WSJ/Vistage Nov 2020]

Highlights:

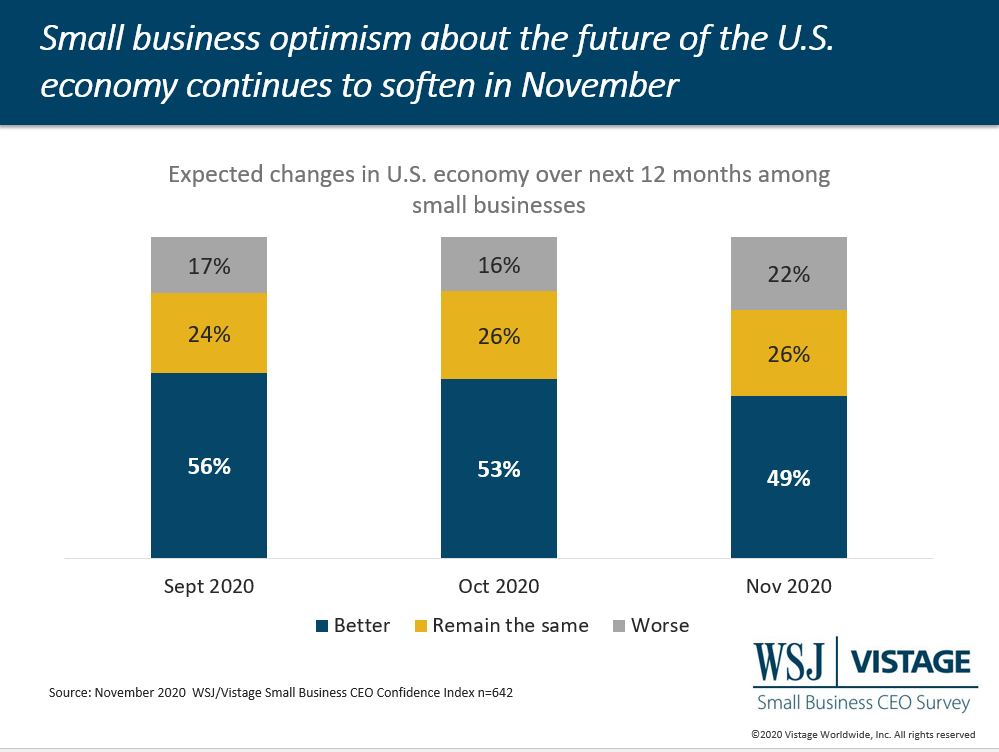

- Optimism about the U.S. economy continues to soften with less than half (49%) of small businesses expecting the economy to improve in the next 12 months, a 4-point decline from October 2020 and 7-point decline from September 2020.

- The rise in COVID-19 cases is impacting customers for 62% of small and midsize businesses; revenue and profit expectations have diminished as a result.

- While 60% of small businesses report cash reserves that will carry them 6 months or more, the lack of new economic stimulus is causing small businesses to hold off on expansion plans.

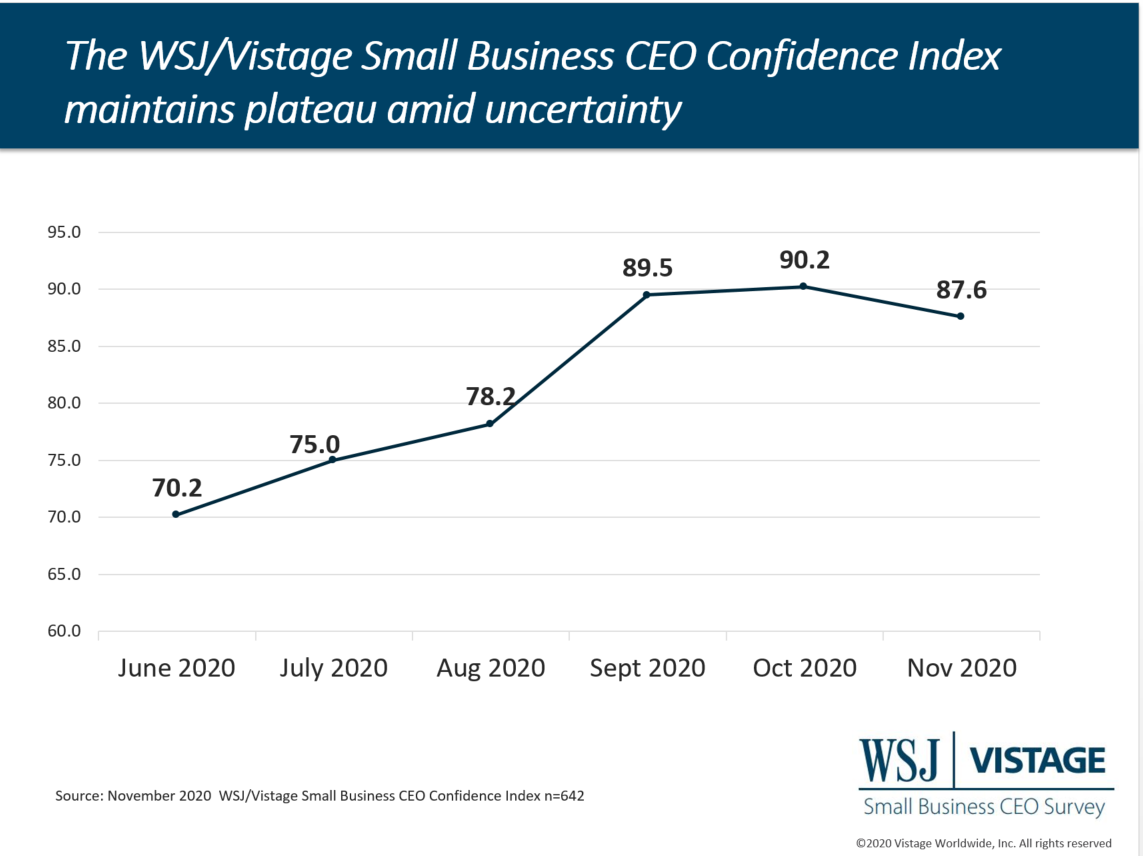

After climbing for six consecutive months, the WSJ/Vistage Small Business CEO Confidence Index declined slightly to reach 87.6 in November 2020. Deepening restrictions and surges in COVID-19 cases have impacted customers and employees for small businesses, which is reflected in declines in nearly all of the key factors that comprise the Index.

Download the November WSJ/Vistage report for the complete analysis

Download the Nov. 2020 WSJ/Vistage infographic

Economic sentiment was the biggest variable in the dip in confidence

As the survey opened, optimistic news included post-election market gains with favorable employment data with a drop in unemployment and jobs gains that surpassed expectations, positive signs that led to a continued decrease in pessimism among small businesses. Of all the components that comprise the Index, recent performance of the U.S. economy was the only component that improved from October; 75% of small businesses reported that the economy recently worsened compared to 81% last month and 83% in September.

However, sentiment about the future of the U.S. economy is less optimistic — less than half of small businesses (49%) reported expectations that the economy would improve in the next 12 months, a two-month downward trend. Moreover, 22% of small businesses expect the economy to worsen in the next 12 months, which is up five percentage points from 16% in October. The restrictions and shut-downs as a result of the surge in COVID-19 cases globally has had impact on the economy as well as customer activity.

COVID-19 surge impacts customers, revenue projections

According to Johns Hopkins, the U.S. surpassed 10 million cases on November 9, the day the survey opened. When asked about how the recent rise in cases impacted their business, customers topped the list with 62% of small business CEOs reported that their customers were impacted. A slowdown in customer activity led to declining projections for revenues and profitability by CEOs surveyed as well.

Marginal declines in expansion plans and prospects

With customer activity slowing, this slowed revenue and profit expectations of small businesses in the year ahead as well; 64% expect increased revenues in the next 12 months, down from 66% in October and 51% expect increased profits, down from 54% last month.

This also has impacted expansion plans among small businesses, those who plan to increase their workforce in the year ahead slid to 55% from 59% in October. Investment plans incrementally declined as well with just 33% of small businesses planning to increase investments in the year ahead. As long as the pandemic is impacting customers and revenues, expansion plans will remain on hold as well.

The pause in expansion plans can also be attributed to Paycheck Protection Program loan funds being depleted and no new stimulus on the horizon. Indeed, just one-third of small businesses think the economy with improve in three months or less; two-thirds believe it will take six months or longer. And when asked about the top government policy priority, small business leaders reported economic stimulus, followed by public health.

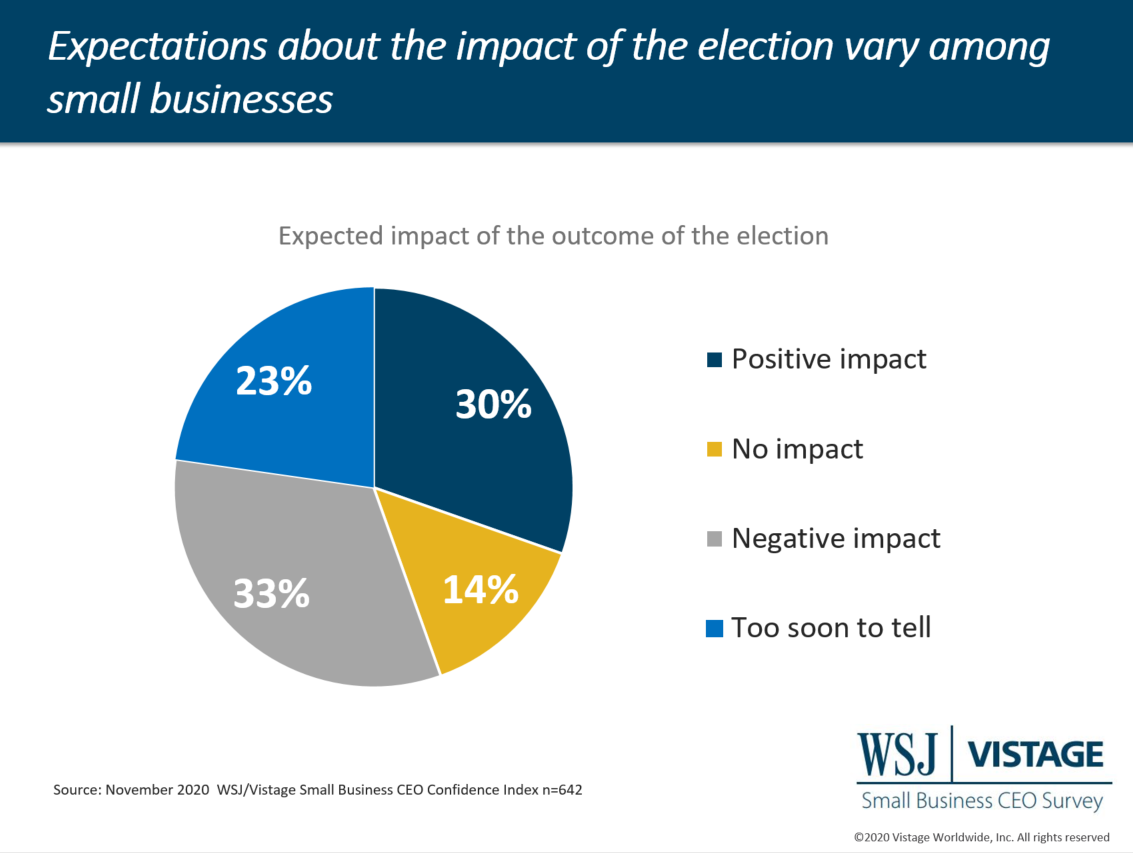

Small businesses divided on election outcome

The outcome of the election led to concerns about the future for one third of small businesses; 33% reported that the election would have negative outcome on their business. Their concern is likely driven by expected policy changes of the new administration and speculations about a less friendly business environment. However, a nearly equal proportion of small business CEOs (30%) thought the outcome would have a positive impact. This division among small businesses is a function of their industry, geographic location and markets and how the policies of the new administration would positively or negatively impact their business.

Nearly a quarter of small business leaders (23%) took the position that it was too soon to tell, and 14% believed the new administration’s policies would have no impact on their businesses. As new cabinet members are appointed and policy positions become clear, these proportions are subject to change. However, it is worth noting that economists at ITR Economics believe that the economy does not care what color tie is in the White House; GDP growth is not linked to any party.

Dr. Richard Curtin, a researcher from the University of Michigan who analyzed the November survey results summarizes what we can expect in the future. “Once more is known about the distribution of the vaccine and the economic policies and regulations proposed by the Biden administration, small businesses will make more informed decisions about growth prospects for the economy and their own company,” says Curtin. “Unfortunately, this process always takes longer to complete than initially expected.”

Download the November WSJ/Vistage report for the complete analysis

Related links

|

Survey methods The November WSJ/Vistage Small Business CEO survey was conducted November 9 – 16, 2020 and gathered 642 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our December survey, in the field December 7 – 14, 2020 will capture year-end sentiment of small businesses. |

Category: Economic / Future Trends

Tags: Challenging Times Business Strategies, coronavirus, Small business, US Economy, WSJ Vistage Small Business CEO Survey