Vaccine distribution accelerates small business confidence [WSJ/Vistage Feb 2021]

As vaccines become more widely available and the stimulus accelerates consumer activity, this gives new hope to small businesses focused on reigniting their growth engine. The February WSJ/Vistage Small Business CEO survey confirms this positive outlook, revealing that 72% of small businesses are expecting increased revenues in the next 12 months. This is a 3-point increase from last month and the highest level since the 76% recorded prior to the global pandemic last February.

Download the February 2021 WSJ/Vistage report for the complete analysis

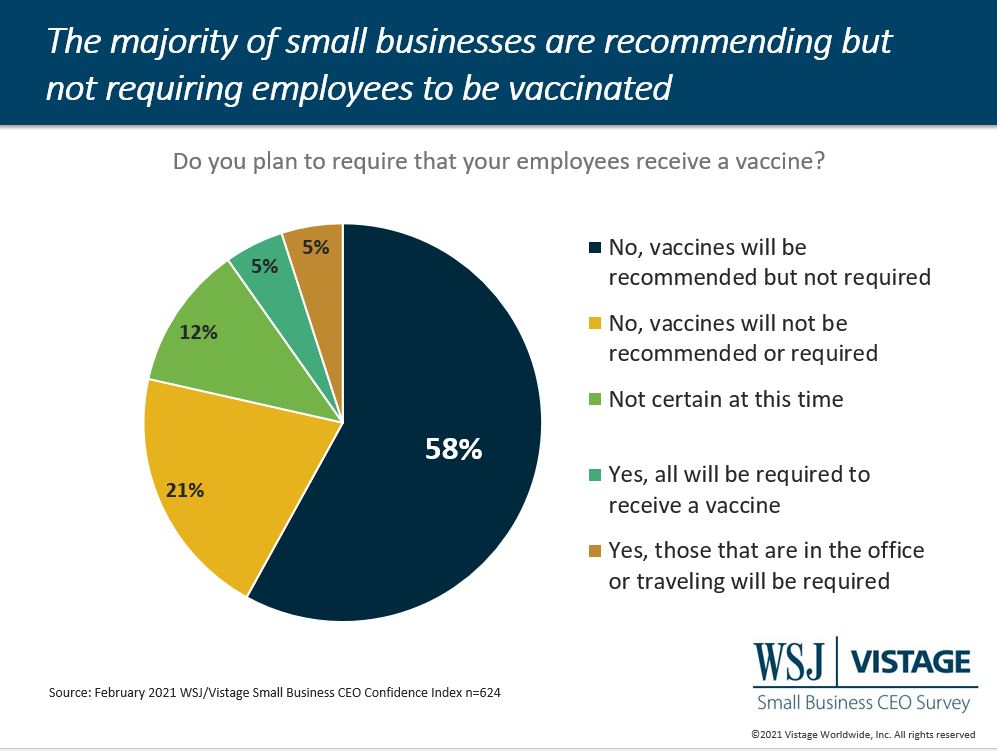

While the promise of accelerated vaccine distribution is a component of their positive revenue projections, small businesses remain divided on their approach to employee vaccines. The majority — 58% of small businesses — are recommending, but not requiring, vaccinations. Another 21% are taking a hands off approach and respecting employees’ personal choice by not recommending or requiring vaccines. Just 10% of small businesses are requiring vaccines, as vaccines are essential to their employees safely engaging with customers, coworkers, clients or patients.

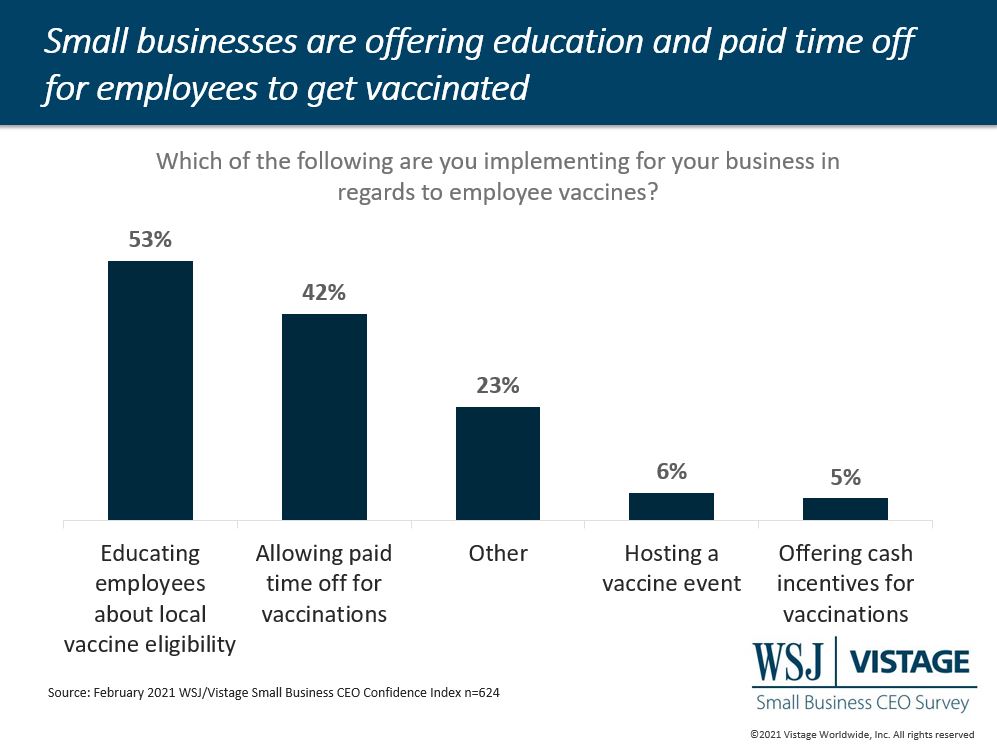

Whether requiring or just recommending vaccines, small businesses must look at how they can support employees during this time. This can include having a role in educating employees on eligibility and availability of vaccines, as well as providing time off for employees to get the vaccination once they become eligible. These practices have been adopted by many small businesses as our survey revealed that 53% are providing education and 42% are providing paid time off. As vaccines become available to broader segments of the population based on local plans, these numbers will increase.

Top concerns of small businesses center around the economy

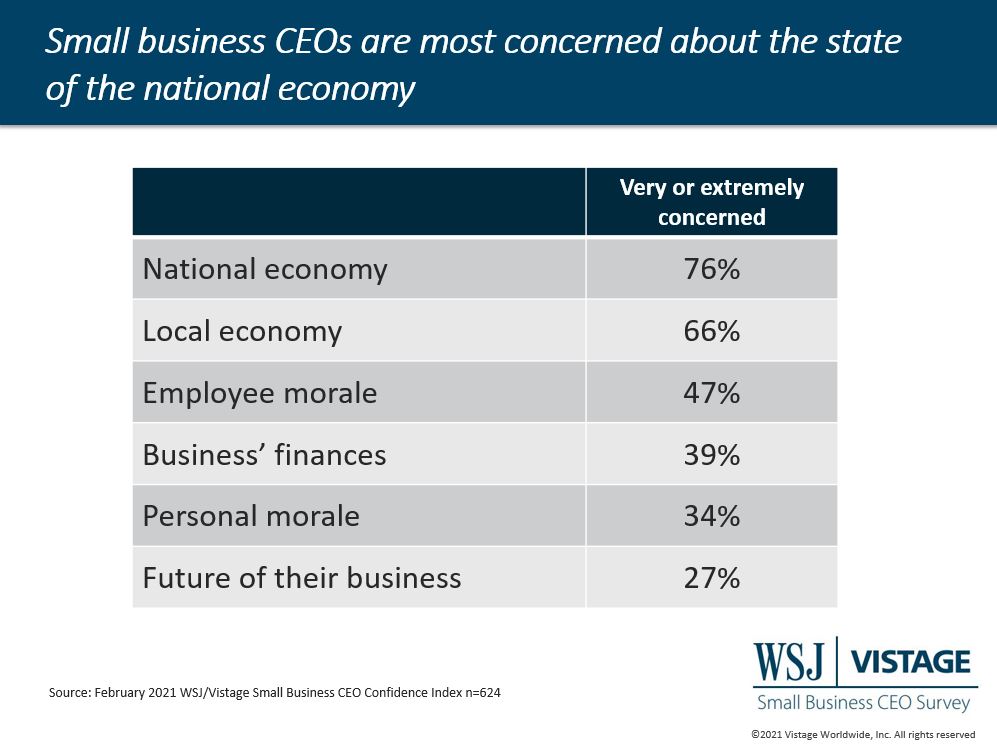

When asked about their biggest concerns, small business CEOs reported their concerns about the economy were more significant than concerns about their own business. More than three-quarters of CEOs (76%) indicated they were very or extremely concerned about the national economy, and two-thirds (66%) were concerned about their local economy.

Conversely, small business CEOs were less concerned about prospects for their business as just 27% indicated they were very (18%) or extremely (9%) concerned about their business’s future. This concern — or lack of it — reflects their increasingly positive revenue and profitability projections.

Morale continues to be a concern for small businesses. This was first revealed in our Q4 2020 CEO Confidence Index survey which found that the top leadership challenge reported by CEOs was morale. Their specific responses included things like morale, employee engagement, stress, Zoom fatigue and COVID fatigue. The February survey confirmed this is still a concern, although CEOs are currently more concerned about employee morale (47%) rather than their own personal morale (34%).

This brings a word of caution for leaders. Just as flight attendants recommend that you put your oxygen mask on before taking care of those around you, leaders need to take care of themselves first. As Dr. Eve Meceda shared in our webinar on the topic of addressing morale, leaders need to take care of themselves first as “you can’t pour from an empty cup.”

Our time with the pandemic is waning, but it will not be over soon. The energy around rebooting business activity, rebuilding the business to maximize on recovery has accelerated. In this time of transition as we wait to enter the new reality, leaders should focus on putting the plans and people into place to be able to realize those revenue expectations.

February WSJ/Vistage Small Business CEO Confidence Index

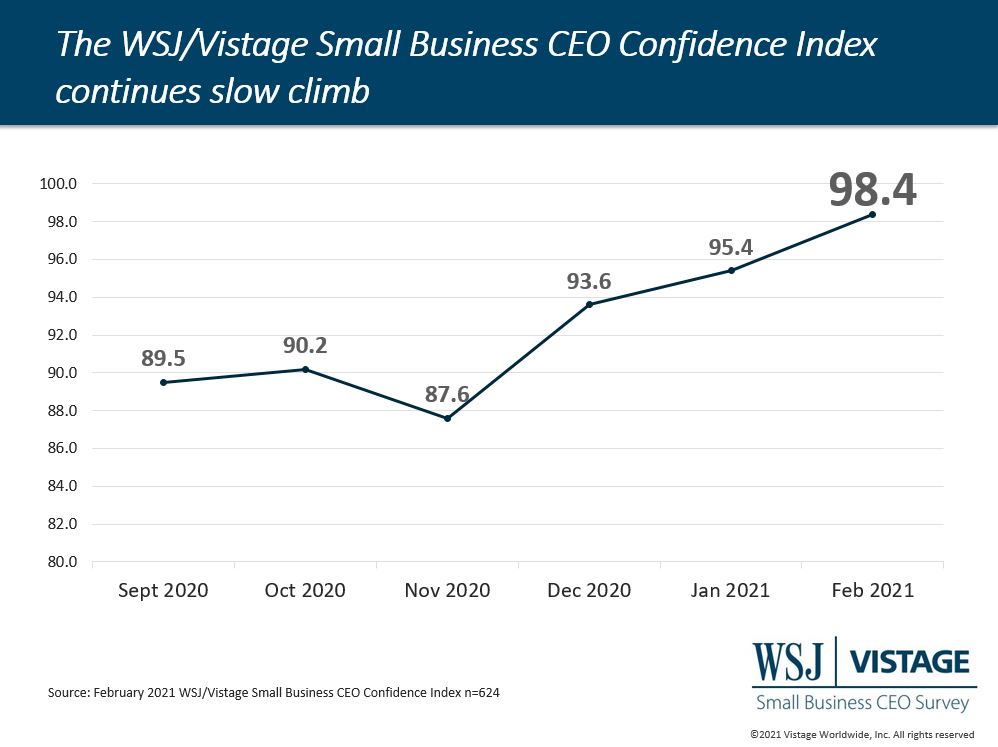

The WSJ/Vistage Small Business CEO Confidence Index rose for the third consecutive month on the slow climb towards pre-pandemic levels. The WSJ/Vistage Small Business CEO Confidence Index was 98.4 in February, up from last month’s 95.4 and just 7% below last February’s 105.7.

While positive revenue projections were a factor in the increase of the Index, the most significant driver was the 11-point drop in the proportion of CEOs that believe the economy worsened compared to a year ago. This is the last month that our survey asks CEOs to compare a pre-pandemic economy to a pandemic economy, so this drop will only continue in our March survey.

The stimulus packages will also positively impact small business confidence as well. Dr. Richard Curtin, a researcher from the University of Michigan who analyzed the data, notes that “The positive impact of the stimulus was clearly evident in how small businesses viewed their expected gains in revenues and profits, as well as expected increases in hiring and fixed investments.”

Download the February 2021 WSJ/Vistage report for the complete analysis

Related links

- Get the full February 2021 WSJ/Vistage report infographic

- Interactive tool: vistageindex.com

- About the WSJ/Vistage Small Business CEO Confidence Index

|

Survey Methods The February WSJ/Vistage Small Business CEO survey was conducted February 1-8, 2021 and gathered 624 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our Q1 2021 CEO Confidence Index survey, in the field March 1 – 8, 2021 will capture sentiment of small and midsize businesses as vaccine distribution accelerates and the anniversary of the pandemic approaches. |

Category: Economic / Future Trends

Tags: Challenging Times Business Strategies, coronavirus, Small business, US Economy, WSJ Vistage Small Business CEO Survey