Small businesses project growth, struggle to expand workforce [WSJ/Vistage May 2021]

With nearly 8-in-10 small businesses reporting expectations for increased revenues, the May WSJ/Vistage Small Business CEO survey also revealed that a greater proportion of small business CEOs are investing in their future; 75% of small businesses plan to expand their workforce in the next 12 months, up from 71% last month. And 50% plan to increase fixed investment spending compared to 47% last month. With business activity picking up and interest rates remaining low, it is a good time to invest.

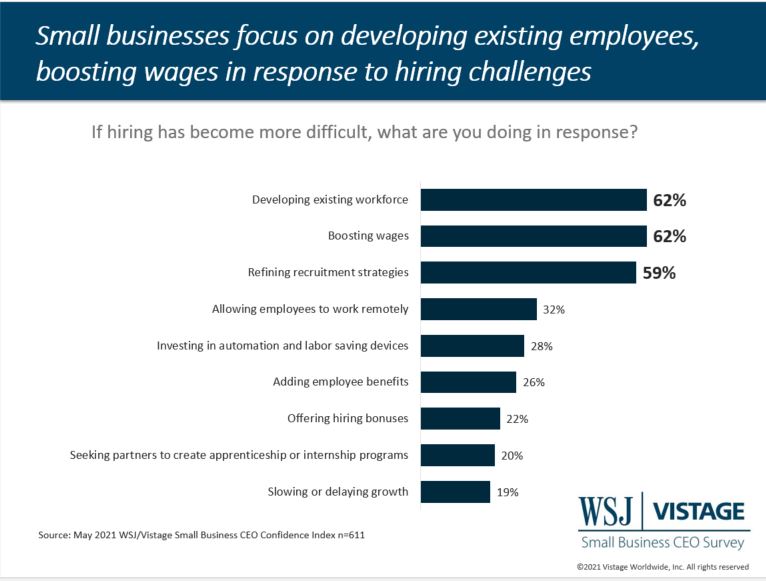

Investments in expanding the workforce do not come without a challenge. When asked about hiring, 69% of small businesses indicated they had challenges finding qualified employees. Open-ended responses indicate that finding hourly workers is a specific challenge facing small businesses as those workers are the biggest beneficiaries of the stimulus programs. Examining wages is critical to understand how to compete with stimulus dollars, and 62% of small businesses challenged with hiring report they are boosting wages. Small businesses need to also compete on different levels other than wages, thinking about how they position their employment brand in recruiting efforts and how they develop the workforce they have today, all investments in the future.

DOWNLOAD MAY 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

While small business confidence increases, pace of growth slows

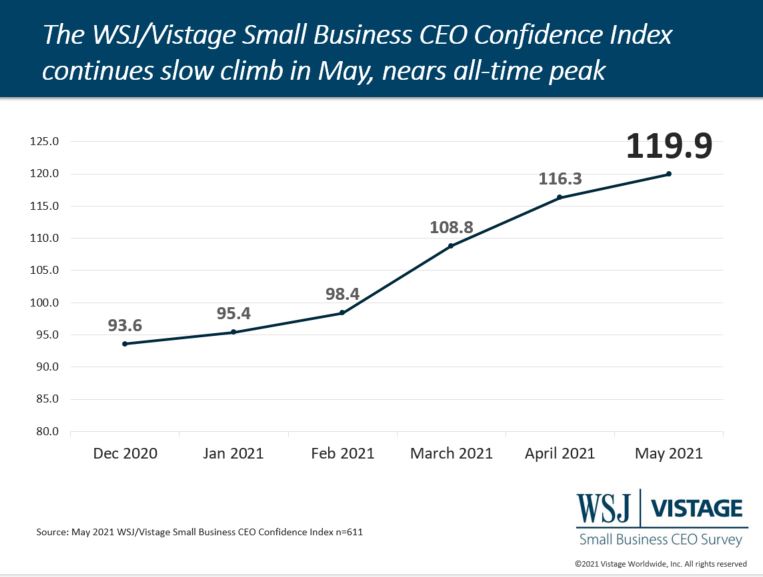

Confidence among small businesses continues to climb, although at a slower rate, in the most recent survey conducted by Vistage in partnership with the WSJ. The May WSJ/Vistage Small Business CEO Confidence Index reached 119.9, an increase from 116.3 last month.

While the trend remains positive, the pace of gains in overall small business confidence is slowing; the jump between February and March showed 10.6% gain, whereas the most recent gain is just 3.1%. Of the six components that comprise the Index, sentiment about the economy had the biggest impact on these tempered gains.

Economic sentiment of small business leaders is increasingly positive

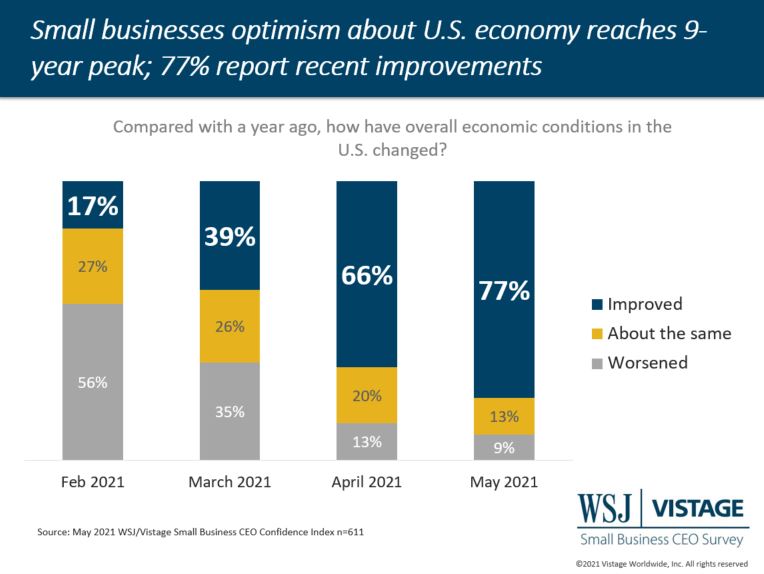

The components of the Index related to the U.S. economy reflect the best and the worst in month-over-month changes. Comparing today’s economy to the dark days of last April and May when we were at the depths of the pandemic, it’s expected that we see improvements; 77% of small business leaders report the economy has recently improved, the most significant month-over-month gain in all components that comprise the Index at 9.8% and the highest level recorded in the 9-year history of the survey.

Looking forward, small business sentiment about continued economic improvements has hit a plateau. For the third month in a row, two-thirds of small businesses report expecting improvements in the year ahead, and 11% maintain expectations that conditions will worsen. While there were no gains in the proportion that expect improvements, the fact that 66% of small businesses expect economic improvements is a healthy indicator of the future, and small business projections for their own revenues is even healthier, with 79% expecting increased revenues in the next 12 months.

Marketing investments increase to capitalize on the surge

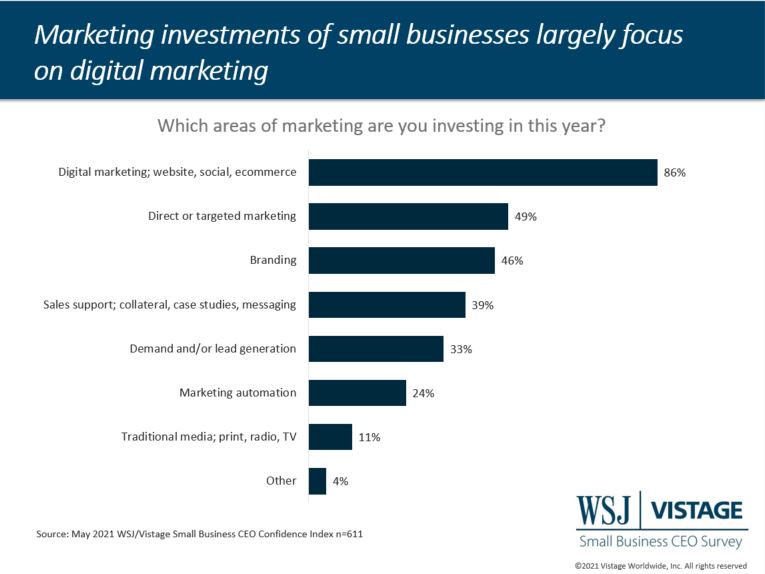

With strong revenue projections, small businesses are investing in marketing to capitalize on the surge. After a year of longer sales cycles and disengaged prospects, customers are coming out of hibernation. To engage with new clients and customers, over half (54%) of small businesses report their marketing budget will increase over pre-pandemic levels, while 40% expect it to remain the same. Their primary investment is in digital marketing, with 89% of small businesses reporting digital marketing as the focus of their marketing investments.

A recent Vistage webinar — Marketing in a post-COVID Marketplace — shares actionable perspectives from three experts on marketing, delving into the changing tactics CEOs should consider for their marketing efforts.

Download the May report for complete data and analysis

For the complete dataset and analysis of the May WSJ/Vistage CEO Confidence Index survey from Dr. Richard Curtin, download the report and infographic to learn more, including:

- Improving optimism about the economy

- Investment and hiring plans continue to grow

- Revenue and profit expectations rise slightly

>>DOWNLOAD MAY 2021 WSJ/VISTAGE SMALL BUSINESS REPORT

>>DOWNLOAD MAY 2021 WSJ/VISTAGE SMALL BUSINESS INFOGRAPHIC

Related links

- About the WSJ/Vistage Small Business CEO Survey

- Interactive data from WSJ/Vistage Small Business survey

|

Survey Methods The May WSJ/Vistage Small Business CEO survey was conducted May 3-10, 2021 and gathered 611 responses from CEOs and leaders of small businesses with revenues between $1 million and $20 million. Our June survey, in the field June 7-14, 2021, will capture sentiment of small businesses as pent up demand is released. |

Category: Economic / Future Trends

Tags: Challenging Times Business Strategies, coronavirus, Small business, US Economy, WSJ Vistage Small Business CEO Survey